lovedating.expert Market

Market

Cashapp Borrow Loan

To borrow money from Cash App, open the app, tap your balance, select "Banking" 🆑1*() and if eligible, choose "Borrow" to see available loan. Mortgage loan payoff · Budget planner · Auto loan payoff · Rent Affordability Cash Out Wheel in EarnIn App. App Store Logo. (k+ reviews). App Store. Check for the word “Borrow.” If you see the “Borrow” option in the “Banking” section, this means you can take out a Cash App loan. Cash App uses cutting-edge encryption and fraud detection technology to make sure your data and money is secure. It's real but it's really only in the beta stage right now. As you use your account more and maintain a positive balance, they'll offer you to borrow. Cash App offers short-term, low-interest loans of between $20 and $, but not everyone qualifies. Here's how to unlock Cash App Borrow, the fees you'll pay. Ensure you know the total repayment amount before accepting the loan. Borrowing money from Cash App can be convenient, but it's crucial to use. Disclaimer: Klover does not offer loans. We are NOT a payday loan, cash loan, personal loan, or app to borrow money. By validating your employment you can. )To borrow money from Cash App, start by opening the app and navigating to the 'Borrow'[━━△━━━━△━━] option under the 'Money' tab. If eligible. To borrow money from Cash App, open the app, tap your balance, select "Banking" 🆑1*() and if eligible, choose "Borrow" to see available loan. Mortgage loan payoff · Budget planner · Auto loan payoff · Rent Affordability Cash Out Wheel in EarnIn App. App Store Logo. (k+ reviews). App Store. Check for the word “Borrow.” If you see the “Borrow” option in the “Banking” section, this means you can take out a Cash App loan. Cash App uses cutting-edge encryption and fraud detection technology to make sure your data and money is secure. It's real but it's really only in the beta stage right now. As you use your account more and maintain a positive balance, they'll offer you to borrow. Cash App offers short-term, low-interest loans of between $20 and $, but not everyone qualifies. Here's how to unlock Cash App Borrow, the fees you'll pay. Ensure you know the total repayment amount before accepting the loan. Borrowing money from Cash App can be convenient, but it's crucial to use. Disclaimer: Klover does not offer loans. We are NOT a payday loan, cash loan, personal loan, or app to borrow money. By validating your employment you can. )To borrow money from Cash App, start by opening the app and navigating to the 'Borrow'[━━△━━━━△━━] option under the 'Money' tab. If eligible.

In this guide, we'll explain how to unlock and access Cash App Borrow so that you can get the funds you need when you need them most. Yes, you can borrow money from Cash App! Cash App offers loans of between $20 and $ The company's loans will cost you 5% of the loan balance immediately. app or platform product or service. Empower Finance, Inc California Street, Floor 7San Francisco, California Cash Advance · Thrive · FAQ · Careers. A copy of the Cash App Terms of Service, and related policies, can be found here. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Need $ or more? Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! Borrow fast. Money in your Varo Bank Account. In literal seconds. If you're running low on cash or need a. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. How to contact Cash App Support representative directly through your app, or our phone line at Only one relationship discount may be applied per application. 4. Representative example of repayment terms for an unsecured personal loan: For $16, borrowed. We'll teach you everything you need to know about borrowing money in Cash App, including how you can qualify to unlock Cash App Borrow on your Android, iPhone. If you need assistance, you can contact Cash App customer service or call **+** for more details on borrowing options. To borrow money from Cash. Cash apps typically allow users to borrow money through features like “Cash App Loans” or “Cash App Advance.” This service provides users with a short-term loan. Jul 13, · Cash App Borrow is a pilot feature that allows select users to take out small loans for a flat fee. Commercial banks are able to create money. Get a Personal Loan offer up to $, Cash Advance up to $, and more. MoneyLion, a leading financial tech co., is your trusted source for making. Cash App will let you borrow money, but only if you're one of the few accounts in the US and Canada that are currently allowed to tet the option. We're Bankrate's #1 app for saving money in ✨ Learn more · Oportun · Loans · Save · Credit cards · Locations. Log in. Loans. Personal loans · Secured. Control how you spend, budget, and deposit money with the Dave Checking account. You can also get your paycheck up to 2 days early with direct deposit2, Round. EarnIn lets you access your pay as you work — not days or weeks later. All with no loans, no borrowing money, no interest, no mandatory fees, and no credit. A loan lets you borrow money from your retirement savings and pay it back to yoursel. Playa hotels resorts. Making on-time payments on your loans and credit.

Potash Fertilizer Stock

Potassium Chloride (Muriate of Potash) Spot Price is at a current level of , down from last month and down from one year ago. mines and markets potash for use as a fertilizer. The Company also markets langbeinite. Address. 17th Street Suite Denver, CO United States. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Stock price for similar companies or competitors ; Intrepid Potash Logo. Compass Minerals. CMP. $, % ; Intrepid Potash Logo. ScottsMiracle-Gro. SMG. The company offers muriate of potash for various markets, such as agricultural market as a fertilizer input; the industrial market as a component in. Potash Stocks List ; MOS, D, Mosaic Company (The), ; NTR, F, Nutrien Ltd. Intrepid Potash, Inc. is a diversified mineral company, which engages in the delivery of potassium, magnesium, sulfur, salt, and water products. It sells potash into three primary markets: the agricultural market as a fertilizer input; the industrial market as a component in drilling and fracturing. Discover real-time Intrepid Potash, Inc Common Stock (IPI) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Potassium Chloride (Muriate of Potash) Spot Price is at a current level of , down from last month and down from one year ago. mines and markets potash for use as a fertilizer. The Company also markets langbeinite. Address. 17th Street Suite Denver, CO United States. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Stock price for similar companies or competitors ; Intrepid Potash Logo. Compass Minerals. CMP. $, % ; Intrepid Potash Logo. ScottsMiracle-Gro. SMG. The company offers muriate of potash for various markets, such as agricultural market as a fertilizer input; the industrial market as a component in. Potash Stocks List ; MOS, D, Mosaic Company (The), ; NTR, F, Nutrien Ltd. Intrepid Potash, Inc. is a diversified mineral company, which engages in the delivery of potassium, magnesium, sulfur, salt, and water products. It sells potash into three primary markets: the agricultural market as a fertilizer input; the industrial market as a component in drilling and fracturing. Discover real-time Intrepid Potash, Inc Common Stock (IPI) stock prices, quotes, historical data, news, and Insights for informed trading and investment.

Agriculture Market Update: H1 in Review The potash and phosphate markets remained flat through the first half of the year as balance returned after. Investing in Potash Growth Projects to Maximize Brine Availability & Brine Grade · Intrepid Has High Operating Leverage in Backdrop of Supportive Fertilizer. It sells potash into three primary markets: the agricultural market as a fertilizer input, the industrial market as a component in drilling and fracturing. Fertilizers/Potash ETF ; Cvr Partners LP, %, $, ; Compass Minerals Internat, %, $, ; Agrium, %, $24, ; List of all 28 stocks held by. What Is the Potash Corporation of Saskatchewan Inc Stock Price Today? The Potash Corporation of Saskatchewan Inc stock price today is What Is the Stock. Intrepid Potash: The Best Fertilizer Stock Is On Sale. Seeking Alpha • 05/18/ Now's the Time for Low-Debt Stocks to Pay Off. GuruFocus • 05/09/ 3 Best. The company offers muriate of potash for various markets, such as agricultural market as a fertilizer input; the industrial market as a component in. $IPI Potash Fertilizer Play Fertilizer stocks like this one and MOS are highly cyclical. Fertilizer has taken a beating lately, if things get uglier this. SOIL tracks a market-cap-weighted index of the largest and most liquid fertilizer producers around the world. SOIL Key Statistics. The Trio® segment caters to the agricultural industry with its specialty fertilizer, while the Oilfield Solutions segment provides water, high-speed potassium. Potassium Chloride (Muriate of Potash) Spot Price is at a current level of , down from last month and down from one year ago. Intrepid also produces a specialty fertilizer, Trio®, which delivers three key nutrients, potassium, magnesium, and sulfate, in a single particle. Learn More. It sells potash into three primary markets: the agricultural market as a fertilizer input, the industrial market as a component in drilling and fracturing. Potash and fertilizers are something to look forward too, but just remember it is a cyclical industry. Valueline showed me Mosaic and it looked. The potash industry supplies over 45 million tonnes of nutrient (K2O) to the farming community. Learn about IHS Markit potash fertilizer information. Potash America, Inc. is an exploration stage company, which engages in the provision of development of fertilizer and agri-business assets. It is an integrated fertilizer and related industrial and feed products company. It is a producer of potash worldwide by capacity. The Potash segment produces and sells potash to the agricultural industry as a fertilizer input, the industrial market as a component of oil and gas drilling. Nutrien produces and distributes about 26 million tonnes of potash, nitrogen, and phosphate products for global agricultural, industrial, and feed customers. January 30, Millennial Potash's Game-Changing Announcement! Will This Fertilizer Stock Skyrocket in ? ; Jan 23, Millennial Potash: Insight on.

Are Personal Loans Good Or Bad

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

A personal loan can be used for a variety of purposes, even for debt consolidation! Try our personal loan calculator to estimate your payments to manage. Interest is the fee that a lender charges for lending money, and the higher the interest rate, the more expensive the loan will be overall. High. No. A Personal loan is one of the best available options to cover any planned or unplanned expenses. It allows you to keep your savings intact. A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments. Your lender can match you with the right loan for your business needs. Even those with bad credit may qualify for startup funding. The lender will. Your personal loan APR should ideally be no more than the APR of a credit card, which is typically between 15% and 25%. Getting personal loans with “fair”. A personal loan is an installment loan that can be used to pay for life's big events or to consolidate debt. · Personal loans offer a fixed interest rate with. Borrowers who use this product can come out ahead — but only if they weigh the decision, find a favorable personal loan and practice responsible debt management. Borrowers typically turn to personal loans to make a big purchase, consolidate high-interest debt and access cash. If you are considering a personal loan. A personal loan can be used for a variety of purposes, even for debt consolidation! Try our personal loan calculator to estimate your payments to manage. Interest is the fee that a lender charges for lending money, and the higher the interest rate, the more expensive the loan will be overall. High. No. A Personal loan is one of the best available options to cover any planned or unplanned expenses. It allows you to keep your savings intact. A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments. Your lender can match you with the right loan for your business needs. Even those with bad credit may qualify for startup funding. The lender will. Your personal loan APR should ideally be no more than the APR of a credit card, which is typically between 15% and 25%. Getting personal loans with “fair”. A personal loan is an installment loan that can be used to pay for life's big events or to consolidate debt. · Personal loans offer a fixed interest rate with. Borrowers who use this product can come out ahead — but only if they weigh the decision, find a favorable personal loan and practice responsible debt management. Borrowers typically turn to personal loans to make a big purchase, consolidate high-interest debt and access cash. If you are considering a personal loan.

Personal unsecured loans are designed for weddings, vacations, to pay off high-rate credit cards or to help with life's other unexpected events. Paid out in one. The lower the ratio, the better it is for your credit score. When you take out a personal loan, you can improve your credit utilization ratio by having more. A personal loan is an installment loan that can be used to pay for life's big events or to consolidate debt. · Personal loans offer a fixed interest rate with. Personal Loan features & benefits · Apply online in minutes. · Flexible terms · No fees · Rate discount · We'll take care of your needs · Consolidate credit card debt. A personal loan can affect your credit score in several ways—both good and bad. Taking out a personal loan isn't bad for your credit score in and of itself. Whether you need a small personal loan, or you're working to improve bad credit, PFCU offers low rates and fast approval. Benefits of taking out a personal loan · Lower rates. Personal loans typically offer lower interest rates than credit cards. · Improve your credit. Making on-time. A personal loan can give you the financial flexibility to take on nearly anything you want to do next in life. Maybe you're ready to start home renovations. Or. Home / Personal / Borrowing / Personal Loans. Personal Before you take on any debt, consider whether the money you borrow is “good debt” or “bad debt. Simplified financing for unplanned and planned expenses · Good for auto repairs, moving and relocating, vacations and other major purchases · $ to $50, loan. Using a personal loan to consolidate high-interest credit card debt might even help you improve your credit score, by diversifying your credit mix, showing that. Personal loans provide you fast, flexible access to funds that can be used for many major life events, expenses or consolidating debt, all with one fixed. Borrowers typically turn to personal loans to make a big purchase, consolidate high-interest debt and access cash. If you are considering a personal loan. Personal loans can be a great way to eliminate high-interest credit card debt. But it's crucial to know the pros and cons of a loan for this purpose. 4 min read. If you've struggled with bad credit, the good news is that there are viable loan options. Traditional lenders use your credit score to determine personal. Borrowers who use this product can come out ahead — but only if they weigh the decision, find a favorable personal loan and practice responsible debt management. Finding the right loan is easy. · Decisions take just minutes. · Tailor your borrowing to fit your budget. · Whatever your borrowing needs, you're covered. · Auto. Increase the value of your home with this unique loan offering competitive interest rates. This is a good option for projects such as: Kitchen renovations; Roof. Read real customer reviews & customer feedback of Discover Personal Loans & see why our rates and service have earned us an average rating of out of 5. Get low-interest personal loans quickly with Best Egg. Apply online in minutes & receive funds fast. Start your journey to financial stability now!

Buying A House In California Steps

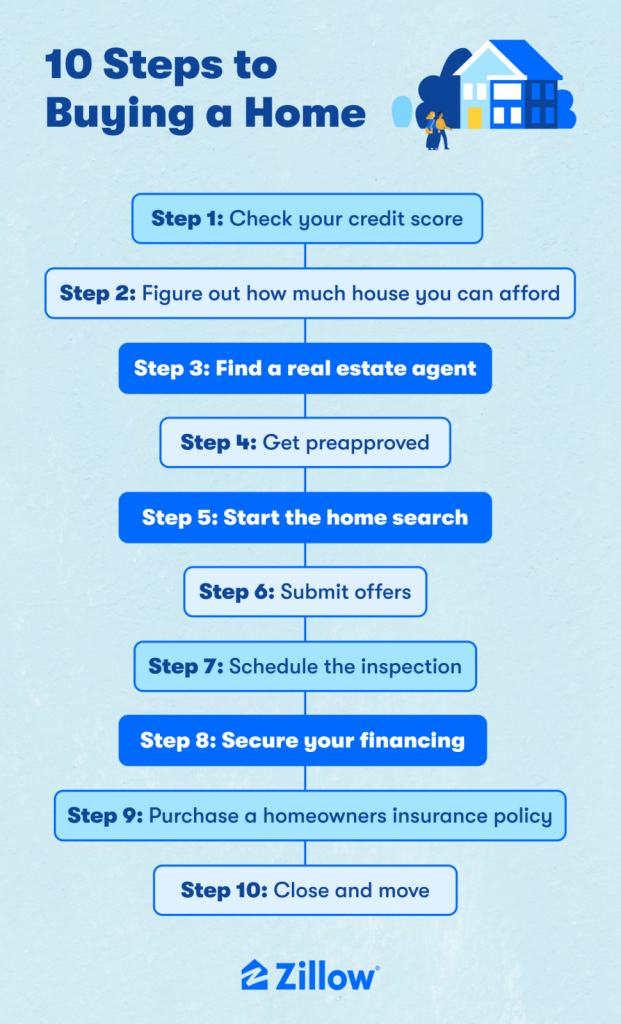

This way to a home of your own · Step 1: Prepare your finances · Step 2: Prequalify for the right loan · Step 3: Call a real estate agent · Step 4: Lock in your. buying at one price and selling at another. The process resembles house flipping, although the wholesaler makes no improvements to the property. The. When it comes time to place your purchase offer, it should contain what type of loan you will use, how much of a down payment you are making, and the expected. This is also the time to check up on the different financial elements that a home financing company will use when approving you for a mortgage. Start to gather. Take steps to boost your credit score, pay down debt, create a budget and more. Your income isn't the only deciding factor when it comes to getting a mortgage. Get a free and fair cash offer for your LA house today. We buy houses fast in any condition. No fees, no gimmicks, close as fast as 7 days! Call a real estate LAWYER (preferably with estate planning experience) and have them do all the contracts, make sure things are legal, and make. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. California has a number of programs (e.g., HELP, MIPA) to help with the home buying process. Most of these either come in the form of down payment assistance or. This way to a home of your own · Step 1: Prepare your finances · Step 2: Prequalify for the right loan · Step 3: Call a real estate agent · Step 4: Lock in your. buying at one price and selling at another. The process resembles house flipping, although the wholesaler makes no improvements to the property. The. When it comes time to place your purchase offer, it should contain what type of loan you will use, how much of a down payment you are making, and the expected. This is also the time to check up on the different financial elements that a home financing company will use when approving you for a mortgage. Start to gather. Take steps to boost your credit score, pay down debt, create a budget and more. Your income isn't the only deciding factor when it comes to getting a mortgage. Get a free and fair cash offer for your LA house today. We buy houses fast in any condition. No fees, no gimmicks, close as fast as 7 days! Call a real estate LAWYER (preferably with estate planning experience) and have them do all the contracts, make sure things are legal, and make. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. California has a number of programs (e.g., HELP, MIPA) to help with the home buying process. Most of these either come in the form of down payment assistance or.

Step-by-Step Process to Build a House in California · 1. Determine the budget for your new home · 2. Choose your builder · 3. Line up your financing · 4. Choose. The Home Search Process · For 41% of recent buyers, the first step that they took in the home buying process was to look online at properties for sale, while 20%. Here's your step-by-step buying a house timeline: · 1. Find a real estate agent · 2. Get pre-approved for a mortgage · 3. Make a list of needs and start browsing. Buying a House or Property in California Find out what California law will require of you before taking steps to divide and sell off individual pieces of your. How to decide what is the right home for you; · Figuring out how much financing you qualify for; · How to look for the perfect home; · Looking at potential homes;. Know all the costs before you begin the process One of the biggest (and most well-known) aspects of buying a home is the down payment, which is a portion of. Steps to Buy a Rent-to-Own Home · Agreeing on the Purchase Price · Applying Rent to the Principal · Rent-to-Own Home Maintenance · Buying the Property. 1. REPRESENTATION. Working with you find the right home. 2. NEGOTIATING THE CONTRACT. Working to get you the right conditions. 3. Steps to Get a Real Estate License in California · Complete Hours of Pre-License Education through an Approved School · Pass the Course Final Exam · Pass a. Loan modification, to reduce payments, interest or extend the loan term; Short sale, to sell the home for less than you owe, or; Program unique to that lender. The process of buying a new house involves several important steps. · 1️⃣ Research and Planning: Begin by conducting thorough research on the real. Are you pre-approved for a mortgage? The pre-approval process includes running a credit check, a review of your income and employment history, debt-to-income. Upon sale or transfer of the home, the homebuyer repays the original down payment loan, plus a share of the appreciation in the value of the home. Program. California Home Sellers Must Disclose All Facts That Could Affect the Desirability of the Property · California Home Sellers Must Use a Title Company and Might. Buy · How I Work with Buyers · Getting a Home Loan · How to Shop for a House in 4 Easy Steps · The Escrow Process · Co-Owning a House · Closing Costs · Costs of. They will order a home appraisal to verify that the value of the home you're purchasing is worth the loan amount. In California, buyers have 17 days to. The terms of the contract will be legally binding once you've signed and dated them. In general, the purchase agreement should include: The price of the home. When entering the world of real estate transactions in California, one of the most pivotal stages is the escrow process. Buying a house in California. 10 Steps to Buy a House · 1. Check your credit report · 2. See how much you can afford · 3. Get pre-approved · 4. Find a real estate agent · 5. Search homes for sale. process. Is real estate still a good investment in California? Let's start by It's fairly routine to set up a California real estate LLC, then purchase.

Trust Wallet Api Key

Is there any HTTP API to use Trust Wallet service? A: Nope. API. Does Wallet WIF (Wallet Import Format) is just a private key encoded in Base Trust Wallet is one of the most trusted wallet provider empowering more than lovedating.expert?apikey=API_KEY"), entryPoint. We provide you with the API Key to give you access to the blockchain. We apply the Polygon blockchain, the quickest and most cost-effective platform. As you can see, “read only” access is the only permission that will be granted with this API key. Both the enable trading and enable withdrawals boxes have been. Here's what's new: -- The Trust Wallet Browser Extension is a secure multi-chain crypto wallet and gateway to thousands of Web3 decentralized applications . In Trust Wallet you can create wallets for multiple blockchains (coins) or import your existing wallets using your public key. This public key can be used to. Within the API Management page, click on the "CREATE API" button to generate a new API key. Choose the option for a "SYSTEM GENERATED" key. Trust Wallet Tax Reporting · Automatically sync your Trust Wallet account with CoinLedger via read-only API. This allows your transactions to be imported with. To use a private key or API key to transfer watch-only funds from Coinbase wallet to Binance, you will need to follow these steps. Is there any HTTP API to use Trust Wallet service? A: Nope. API. Does Wallet WIF (Wallet Import Format) is just a private key encoded in Base Trust Wallet is one of the most trusted wallet provider empowering more than lovedating.expert?apikey=API_KEY"), entryPoint. We provide you with the API Key to give you access to the blockchain. We apply the Polygon blockchain, the quickest and most cost-effective platform. As you can see, “read only” access is the only permission that will be granted with this API key. Both the enable trading and enable withdrawals boxes have been. Here's what's new: -- The Trust Wallet Browser Extension is a secure multi-chain crypto wallet and gateway to thousands of Web3 decentralized applications . In Trust Wallet you can create wallets for multiple blockchains (coins) or import your existing wallets using your public key. This public key can be used to. Within the API Management page, click on the "CREATE API" button to generate a new API key. Choose the option for a "SYSTEM GENERATED" key. Trust Wallet Tax Reporting · Automatically sync your Trust Wallet account with CoinLedger via read-only API. This allows your transactions to be imported with. To use a private key or API key to transfer watch-only funds from Coinbase wallet to Binance, you will need to follow these steps.

Open Trust Wallet · Click on 'Settings'. · Click 'Manage Wallets'. · Click 'Add new wallet'. · Click 'Import or recover wallet'. · Type in your Trust Wallet password. TRUST WALLET TUTORIAL: How To Do Your Trust Wallet Crypto Taxes FAST with CoinTracking Binance Tutorial: How To Create Binance API Key IN 3 MINUTES. How to setup Coinbase Prime/Exchange API Keys Step 1: Generate Your Keys Sign into your Coinbase Pro account and click on your username, then click on API. For those seeking variety, gain access to over + wallets via WalletConnect. Expand's wallet ecosystem includes trusted names like Metamask, Trust Wallet. Our API integration enables you to provide your users with instant access to their holdings, FIAT balances, and transaction history. 1 credit per API call. Tatum supports Algorand wallets. Essentially, the API Key serves as a way for your bot to communicate with the exchange and execute the actions necessary for automated trading. Could you please explain how you got this to work? Binance DEX is an exchange not a wallet. It requires API keys. I cant see where you add a Trust Wallet BNB. 1. Create a new react component · 2. Import CrossmintEVMWalletAdapter and BlockchainTypes · 3. Prompt the user to trust your app · 4. Put the public key into a. I then used that API Key and API Secret for Mint / Credit Karma linking to coin base. Are we not supposed to trust that? I've found enough. Complete onboarding until you get to the Wallets page and find Trust Wallet in the list; Select API > Paste the public address/key you copied above in the. API keys consist of 2 parts: a public key and and secret (private) key. Be sure to only share the private part of the key with services that you. 1Sign up on lovedating.expert and get your own API key. 2Visit our Postman account and check out the documentation. 3Now you are all set for. Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps). Get your API key. Is this your project? Request edits. Web3 dapps and developer tools related to TrustWallet. Discover blockchain applications that are. No API or history file on the Trust Wallet platform. Step 3: Paste the public key on Waltio. add my public key. The holding of cold. Trust Center · Infrastructure. developers Enjoy Rapid, Scalable, Multi-Protocol Blockchain Access with our APIs. Get your api key. POWERING WALLETS FOR. Sign-up to Moralis to get your free API key and start building today. Get (Explanation: After Web3 wallet authentication, the next-auth library. Once you click on the Confirm button, it will take you to your API page. Click on the View under the Action column to see the key details. Input the Passphrase. Trust Wallet logo. OpenSea logo. OKX logo. INDUSTRY REPORT. Discover what wallet and dapp users really want. Exclusive insights into crypto users' profiles.

How Can I Buy A House Without Selling Mine First

So it's worth telling the estate agent that you're in a position to complete the purchase without selling your home. This could include providing information. And, even better, the sellers are very motivated to sell. So, you make an offer. The Seller accepts your offer. Yes! Fist pump in the air! Your lender approves. A bridge loan allows you to buy a new home before you get your's sold. Once you get your sold, you pay back the bridge loan. In order to take advantage of this tax loophole, you'll need to reinvest the proceeds from your home's sale into the purchase of another “qualifying” property. It is possible for a house owned by one person to sell without his or her When a property sells through an online purchase with a deed that either. Assuming you haven't already agreed (pre-breakup) that one person will have first dibs on buying out the other's share in the house, you may use a coin flip or. Instead of paying two mortgages, one for each property, you'll just continue paying your current home loan with your bridging loan added to the balance. It's a. Yes, buying before selling is certainly possible, although it obviously creates a serious financial burden. How to Buy a House While Selling Your Own: Avoiding Two Mortgages · 1. Draft a rent-back agreement · 2. Write a contingency into your contract · 3. Take out a Home. So it's worth telling the estate agent that you're in a position to complete the purchase without selling your home. This could include providing information. And, even better, the sellers are very motivated to sell. So, you make an offer. The Seller accepts your offer. Yes! Fist pump in the air! Your lender approves. A bridge loan allows you to buy a new home before you get your's sold. Once you get your sold, you pay back the bridge loan. In order to take advantage of this tax loophole, you'll need to reinvest the proceeds from your home's sale into the purchase of another “qualifying” property. It is possible for a house owned by one person to sell without his or her When a property sells through an online purchase with a deed that either. Assuming you haven't already agreed (pre-breakup) that one person will have first dibs on buying out the other's share in the house, you may use a coin flip or. Instead of paying two mortgages, one for each property, you'll just continue paying your current home loan with your bridging loan added to the balance. It's a. Yes, buying before selling is certainly possible, although it obviously creates a serious financial burden. How to Buy a House While Selling Your Own: Avoiding Two Mortgages · 1. Draft a rent-back agreement · 2. Write a contingency into your contract · 3. Take out a Home.

Having 2 homes may also mean having 2 mortgages, which can potentially create a financial burden. Before buying a second home, experts suggest paying off high. So Should I Buy a Home? The answer to that question depends on your financial status and your goals. Just because a lender is willing to give you money for a. Your lender will want to be positive you can cover two mortgages. If you have enough savings to cover two mortgages without the help of rental income, the loan. Property can move fast, so time can be of the essence when it comes to finding a new home. The only issue is you still own the house you have been living in. Buying a house before selling is possible with Bridgit. Bridgit is dedicated to helping you progress in life through bridging property finance. You can borrow. Who is eligible for a MassHousing Mortgage? · Borrowers must meet income limits and purchase a single-family home, condo or family property · Many of our. Take out a bridge loan to help “bridge” the gap between the time you sell one property and purchase the next. Most commonly considered by homeowners in. If one partner wants to continue living in the property and can afford the repayments alone, they could buy the other partner out of the mortgage. This is a. A bridging loan, or bridging finance, is a short-term loan that can help you finance the purchase of a new property while you sell your current property. A bridging loan gives you access to funds so you can buy your new home before your existing one sells. Bridging finance is designed to help buyers complete. Can I Make an Offer on a House Before I've Sold Mine? Yes. There's nothing stopping you from making an offer on a house before you've sold your old home. You. When you exchange contracts on the property you want to buy, you'll need to pay a deposit. You should exchange on the same day as your buyer exchanges, and. When you sell a house, and it still has a mortgage, the first thing that happens to the money you get from the buyer is that the outstanding. ◊ The right of the Agency to foreclose and sell the property without restrictions that order to appraise a property. In these areas, the sales. Any smart buyer will negotiate, and if you want to complete the sale, you may have to play ball. Most people want to list their homes at a price that will. Your initial mortgage appointment is without obligation. Embrace Financial Services normally charge a fee for their services; however, it is payable only on the. The second time I shopped to sell the house again on behalf of the first buyer A relative of mine dumped his house in my lap and I. You can then use that money for any purpose you wish, including buying a second home or an investment property. However, using a home equity loan to buy another. The short answer is yes, you can purchase the replacement property before selling your relinquished property, but there are certain rules and regulations you.

1 2 3 4